How a Cash Flow Calendar Template Improves Budgeting

See how a cash flow calendar template improves budgeting by aligning income and expenses by date, reducing stress and avoiding surprises.

Track Income and Expenses with a Cash Flow Calendar

Timing is just as important as the money itself when organizing finances in the United States.

For those who deal with frequent movement, coordinating income and payments becomes even more challenging.

It is precisely at this point that a cash flow calendar stops being a supporting tool and starts acting as a central component of financial planning.

What is a cash flow calendar?

A cash flow calendar is a financial calendar that organizes cash inflows and outflows by date, rather than only by category or by month.

Unlike a traditional budget, which answers the question “How much can I spend?”, a cash flow calendar answers a more operational one: “When does the money come in, and when does it go out?”

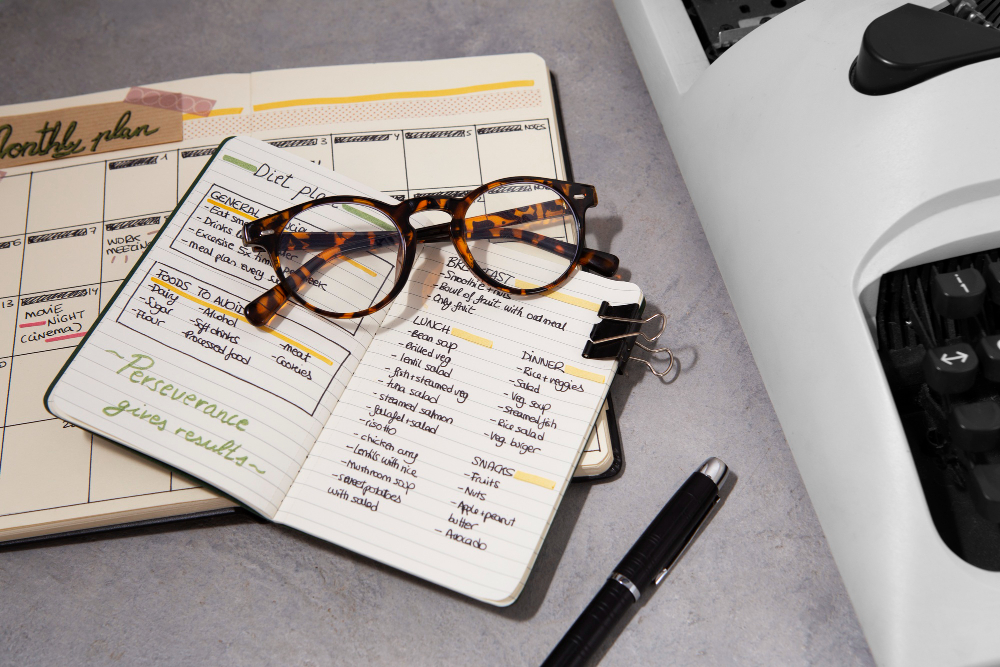

In practice, it is a template—digital or physical—where you record:

- Income receipt dates

- Fixed bill payment dates

- Dates of predictable variable expenses

- Purchases planned in advance

- Seasonal obligations

Why the calendar improves budgeting

A budget without a calendar is static

Most budgets fail not because the numbers are wrong, but because they ignore the time factor.

A monthly budget may “balance” on paper and still produce a negative balance on certain days of the month.

In the United States, this is especially common due to:

- Biweekly or irregular pay schedules

- Bills with different due dates

- Annual or semiannual charges

- Purchases made weeks or months before use

Anticipation replaces reaction

When dates are visible, decisions stop being reactive. Instead of dealing with an unexpected charge, you prepare for it weeks—or even months—in advance.

This dramatically reduces:

- Credit card limit usage

- Interest from late payments or installments

- Emergency transfers between accounts

How a template organizes cash flow

Daily balance visibility

A good cash flow calendar template shows not only expenses but also the projected balance over time. This makes it possible to identify critical days even in months that appear balanced.

Credit card integration

Although the card payment has a specific due date, purchases happen on different days. The calendar helps map:

- When the expense occurs

- Which billing cycle it falls into

- When the money actually leaves the account

Situations where a cash flow calendar makes a difference

Advance bookings and purchases

Flights, lodging, and services are often paid for long before the date of use. Without a calendar, these expenses compete with recurring monthly costs and distort cost perception.

With a template, the purchase stops being an isolated event and becomes part of a continuous financial plan.

Seasonal and irregular costs

Annual insurance, administrative fees, local taxes, renewals, and maintenance do not follow a monthly rhythm. The calendar allows these costs to be spread throughout the year, preventing “overloaded” months.

Multiple income streams

Biweekly pay, freelancing, bonuses, or reimbursements do not arrive on fixed dates. A cash flow calendar helps align financial commitments with actual cash receipt, rather than a theoretical average.

How to build an effective cash flow calendar template

1. Start with real dates

Use exact income and payment dates, not generic estimates. In the U.S., small date shifts can trigger overdrafts or avoidable fees.

2. Separate fixed and variable expenses

In the template, clearly identify what is recurring and what is one-off. This makes adjustments easier when income changes or temporary priorities arise.

3. Include confirmed future events

Planned purchases, bookings, renewals, and annual payments should enter the calendar as soon as they are decided—not only when the charge posts.

4. Update the projected balance

The most important number in the calendar is not the expense itself, but the balance after each transaction. That is what drives decisions.

The psychological impact of a financial calendar

This leads to:

- Greater confidence in decisions

- Less prepayment anxiety

- More consistent planning

A calendar does not replace a budget—it executes it

A cash flow calendar does not eliminate the need for a traditional budget. It works as the layer that turns intention into execution.

In a financial environment like that of the United States—with fragmented charges, decentralized payments, and prepaid costs—planning without considering dates is taking unnecessary risk.

A well-designed cash flow calendar template does more than improve budgeting. It changes how money is perceived, moved, and controlled over time.