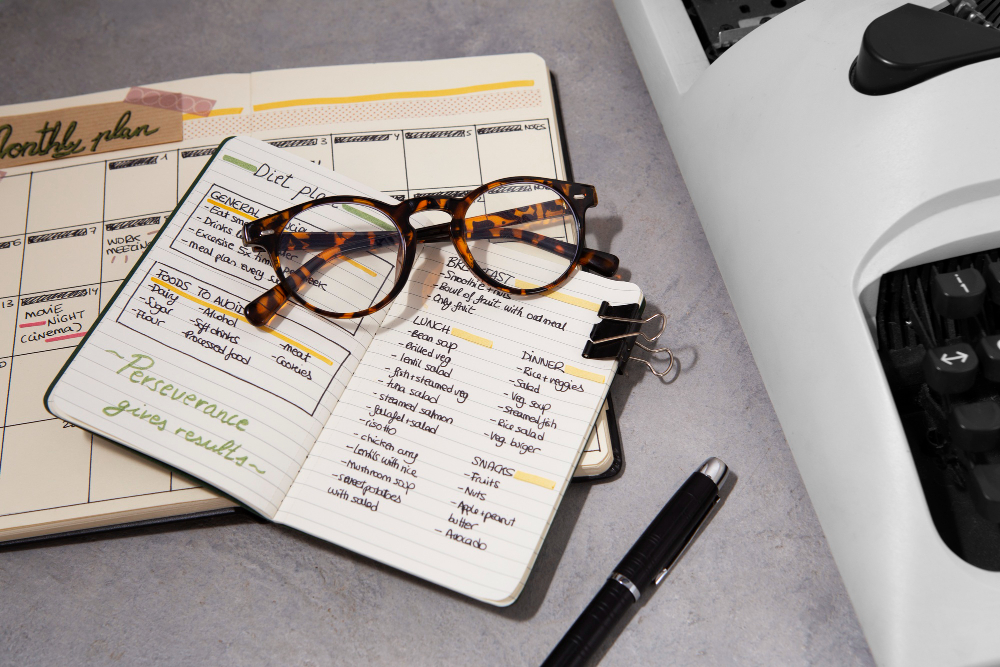

Planning Ahead: When Long-Term Care Insurance Makes Sense

Learn when Long-Term Care Insurance fits into a solid U.S. financial plan and how early planning helps preserve flexibility.

When Long-Term Care Insurance Enters the Conversation

Planning for the future is usually associated with investments, taxes, and retirement. Long-term care, however, almost always takes a back seat.

Not because it lacks importance, but because it feels distant, uncomfortable, and difficult to fit into a lifestyle built around autonomy and flexibility.

Still, in the context of the United States, understanding when Long-Term Care Insurance (LTCI) makes sense is an essential part of a sound financial plan.

The central point is not to anticipate problems, but to reduce uncertainty. Long-Term Care Insurance (LTCI) is not an emergency product; it works best when integrated into a long-term strategy, before decisions have to be made under pressure.

What the U.S. healthcare system covers—and what it does not

The U.S. healthcare system is effective for discrete medical events: doctor visits, tests, surgeries, and short-term hospitalizations.

Private insurance plans and Medicare perform well in this context. The issue arises when the need shifts from clinical care to functional support.

Long-term care involves ongoing assistance with basic activities of daily living, such as bathing, eating, mobility, or medication management.

These services are rarely covered by traditional health insurance. Medicare, for example, only covers very limited periods of skilled care and only when strict medical criteria are met.

In practice, this creates a significant gap between healthcare and assistance—a gap that can lead to high costs and difficult decisions without prior planning.

The role of long-term care insurance in financial planning

LTCI was designed precisely to fill this gap. It does not replace health insurance or Medicare but complements both. Its primary purpose is to preserve choice when autonomy declines.

Depending on the policy, coverage may include:

- In-home care (home care)

- Assisted living facilities

- Nursing homes

- Specialized services for cognitive conditions

Why the “right moment” matters more than age

A common mistake is to associate LTCI exclusively with advanced age. In practice, the most relevant factor is not chronological age but health status and financial stability at the time of purchase.

The earlier a policy is acquired:

- The lower the premium tends to be

- The higher the likelihood of medical approval

- The greater the ability to customize coverage

Waiting too long can result in significantly higher premiums or even denial due to pre-existing conditions.

Mobility, flexibility, and the cost of improvisation

For those who value freedom of movement and open-ended decisions, improvisation is rarely the best strategy.

When long-term care is not planned in advance, it often forces rushed, expensive choices that are poorly aligned with the desired lifestyle.

Without a defined structure, the alternatives typically involve:

- Accelerated depletion of assets

- Financial dependence on family members

- Geographic limitations imposed by cost or service availability

When well designed, LTCI acts as a tool to protect flexibility.

LTCI is not for everyone—and that is part of planning.

It is important to acknowledge that long-term care insurance is not a universal solution.

For some individuals, accumulated assets may be sufficient to cover future care without compromising other financial goals.

For others, insurance is an efficient way to protect assets and reduce concentrated financial risk.

The decision should be based on an assessment of:

- Net worth and liquidity

- Family structure and expectations of support

- Expected duration of residence in the U.S.

- Tolerance for significant financial risk later in life

Common policy types and approaches

The U.S. market offers several LTCI structures. In addition to traditional policies, there are hybrid solutions that combine life insurance or annuities with long-term care benefits.

These structures may appeal to those who:

- Do not want to “lose” premiums if benefits are never used

- Seek cost predictability

- Prefer products integrated with estate planning

Advance planning as a way to preserve choice

Thinking about long-term care is not about anticipating loss of autonomy but about preserving it for as long as possible.

In the United States, where costs are high and the system demands informed decisions, addressing this topic early is a sign of financial maturity.

LTCI makes the most sense when it is incorporated into planning before it becomes urgent. It works best as a quiet component of the strategy—available if needed, but not central to daily life.